Pioneers

In Impact Investing

Turner Impact Capital is one of the nation’s largest and fastest-growing social impact investment firms, positioned to invest over $5.0 billion since our founding to develop real estate solutions that address daunting societal challenges across the U.S.

“Most investors believe if you are going to impose a societal objective on a financial return you’re going to sacrifice yield. I just refute that. Our results do, too.”

Bobby Turner, CEO

Profits with a PURPOSE

Our Investment Strategies

By harnessing market forces, we are creating sustainable solutions to some of our society’s most pressing challenges on a broad, nationwide scale.

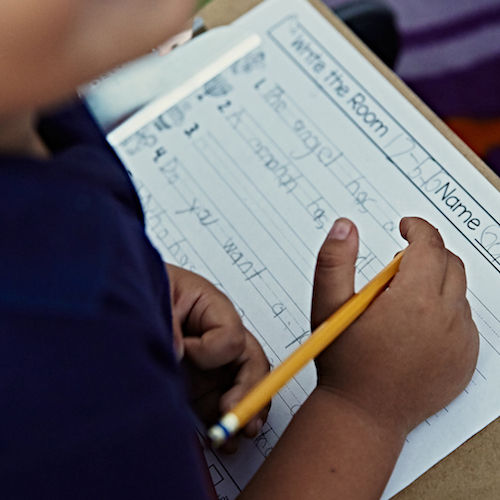

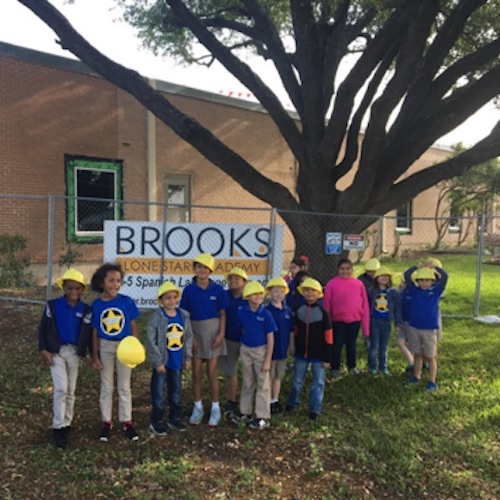

Educational

Facilities

Accelerating the growth of high-achieving charter schools

59,000+

School Seats Created

Multifamily

Housing

Preserving and enriching naturally occurring affordable workforce housing

55,000

Residents Served to Date

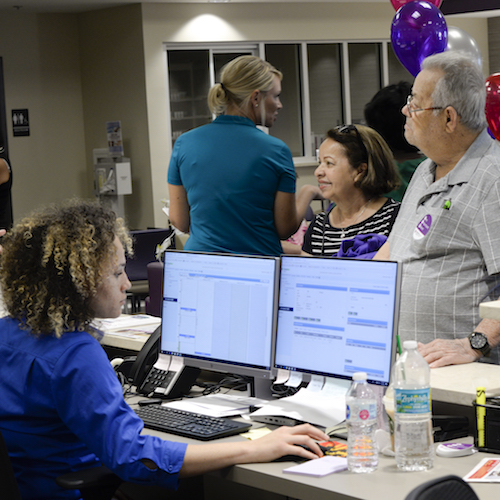

Healthcare

Facilities

Expanding access to high-quality medical care in underserved communities

95,000+

Patient Enrollment Capacity

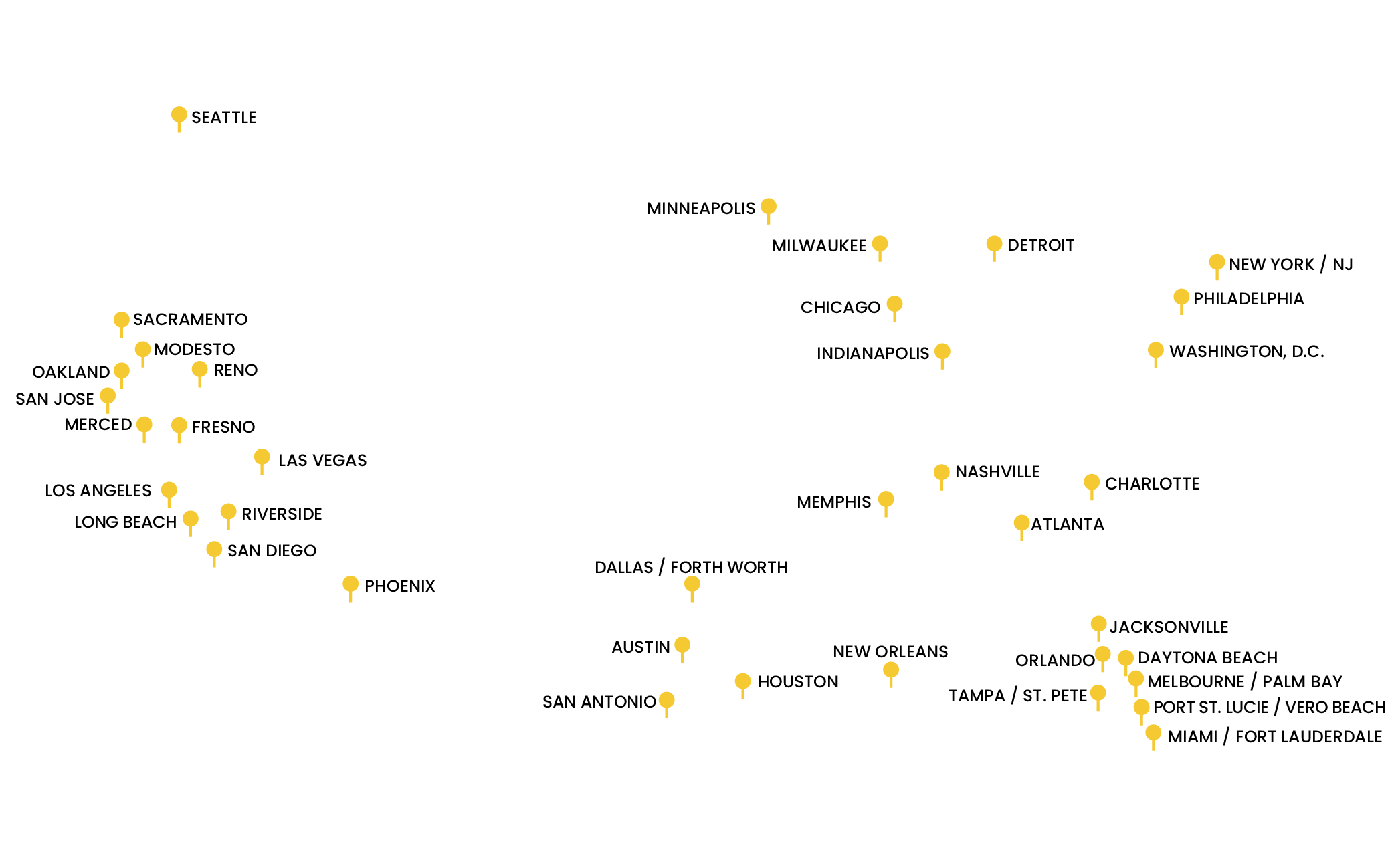

Our Investment Locations

We invest in diverse urban markets throughout the country, targeting underserved areas where we can have the greatest impact. Each investment is intended to serve its surrounding community in order to address existing market needs.

Over 20 Years of LEADERSHIP

in social impact investing

Our Team

Turner Impact Capital’s diverse, experienced professional team is committed to harnessing market forces to create lasting change in the communities where it is needed most.